It is time to prohibit stock trading for members of Congress.

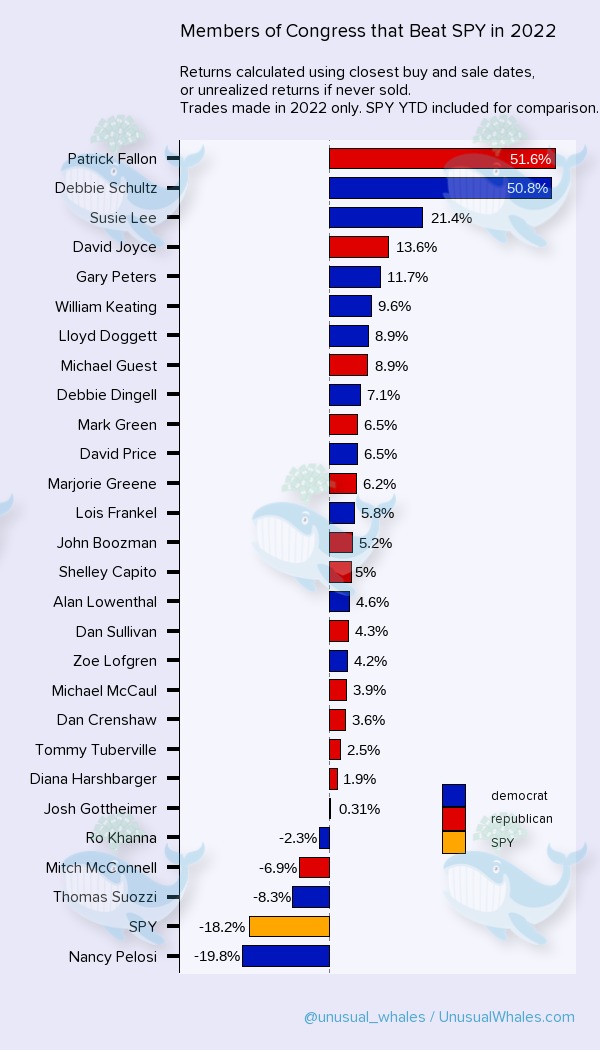

Despite the marketplace having the worst year considering that 2008, Members of Congress as soon as again beat the marketplace.

The S&P 500 was down 18% in2022 Democrats were just down 1.76% and Republicans were up.389% on the year.

Usually, Democrats were down -1.76% in 2022, whereas Republican members were up +0.4%.

Meanwhile, the S&P500 itself was down 18% in 2022.

Like in 2021, political leaders beat the marketplace.

Read the complete report here: https://t.co/6OYED6CbIR pic.twitter.com/6OOEbYWWcR

— unusual_whales (@unusual_whales) January 3, 2023

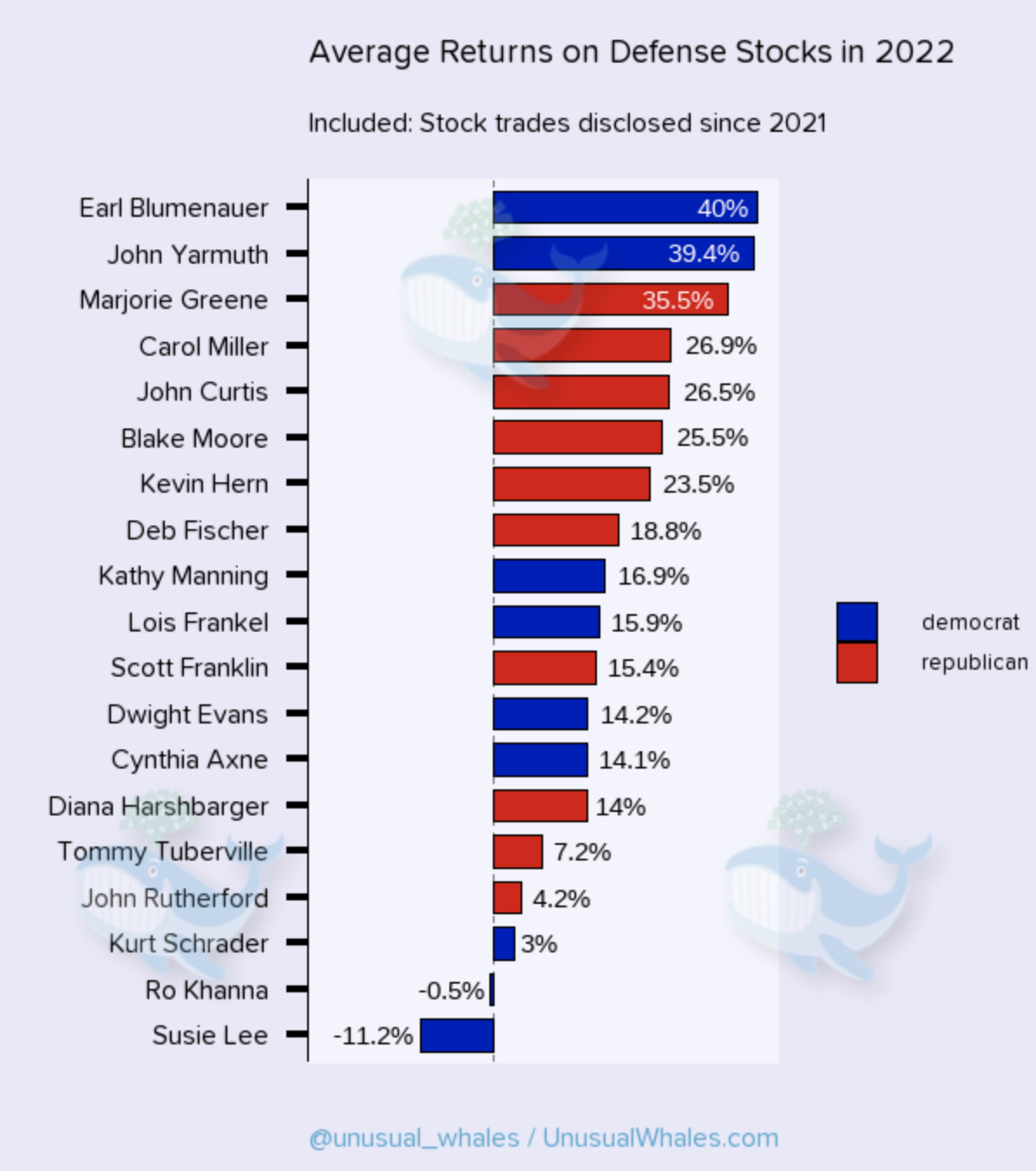

Defense stocks were a cash maker for members of Congress.

Both Democrats and Republicans generated income purchasing defense stocks in the middle of the war in Ukraine.

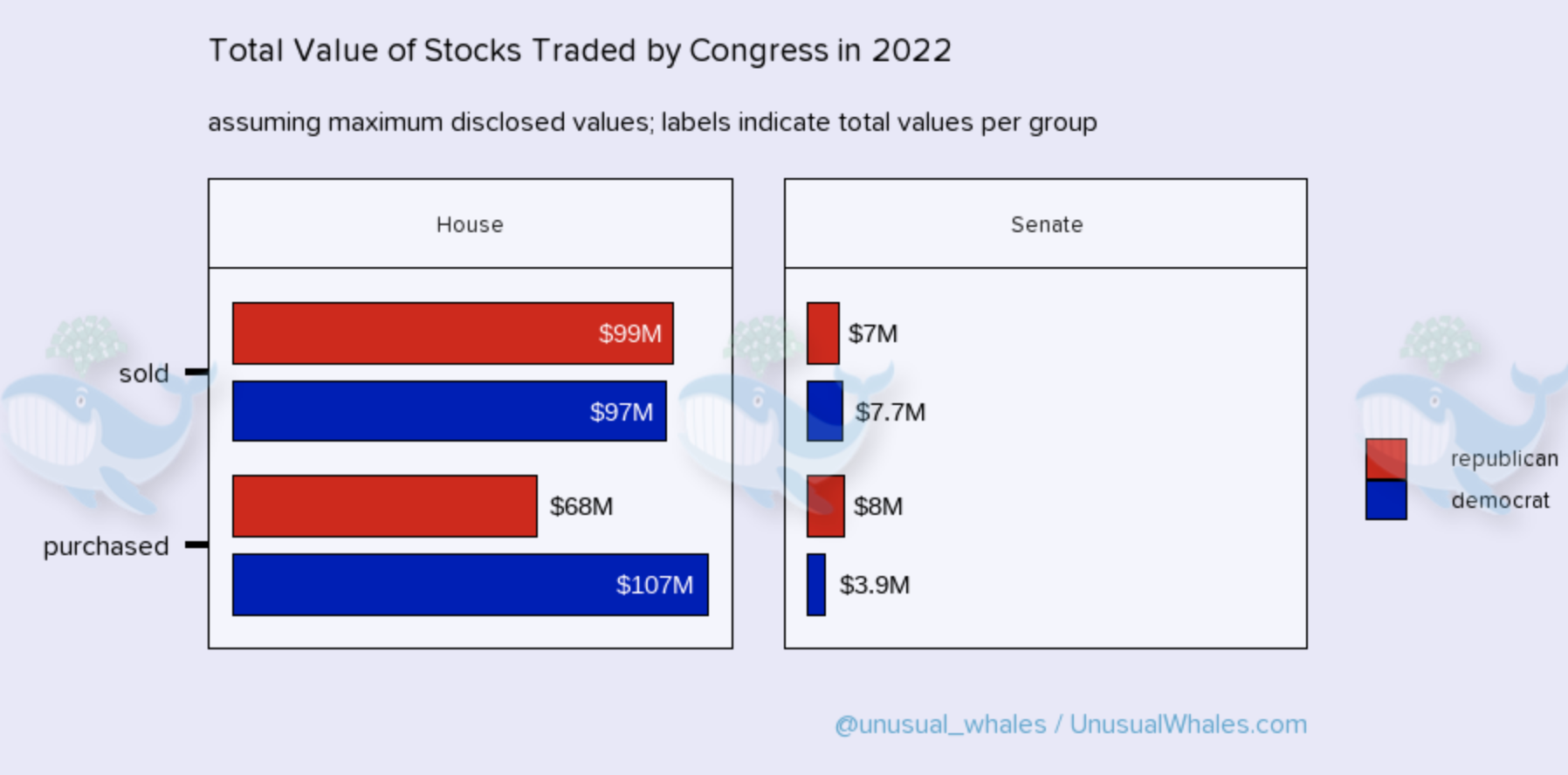

Republicans offered a bit more in stocks in 2022 however Democrats bought much more than Republicans.

After a huge year in 2020 and 2021, Pelosi had a down year in 2022.

Well the Pelosi household had actually a considerably lowered trading year in2022 In 2021 and 2020, they grew, with big outsized returns. We composed whole reports on her trading design, in addition to produced a series of complimentary ETFs to follow her relocations.

…

Pelosi had an awful year with choices, where her deep ITM call method for her tech plays truly did not exercise in2022 She worked out the majority of her plays that ended at a loss, and right away offered those stocks. You can see her active alternatives positions (down 99%) in addition to the ones she worked out listed below:

…

Pelosi likewise included a 50 k interest in an LLC called REOF LLC, bringing the overall REOF financial investment to around 350 k. Ultimately, Pelosi’s methods worked well in 2020-2021, however stopped working as rates of interest increased.

Is this corruption?

For the remedy to media predisposition, have a look at ProTrumpNews.com …

The post CORRUPTION? Members Of Congress Beat the S&P 500 Again– “Unusual Trades Resulting In Huge Gains” appeared initially on The Gateway Pundit

This article may have been paraphrased or summarized for brevity. The original article may be accessed here: Read Source Article.

![President Trump Gives Barron A Shout Out At Inaugural Parade: His Unexpected Response is Pure Gold! [VIDEO] president-trump-gives-barron-a-shout-out-at-inaugural-parade:-his-unexpected-response-is-pure-gold!-[video]](https://news.lateawakening.com/wp-content/uploads/2025/01/35545-president-trump-gives-barron-a-shout-out-at-inaugural-parade-his-unexpected-response-is-pure-gold-video-100x70.jpg)